Missed rendezvous

The art market is a sprawling machine that brings together works of the mind—paintings, sculptures—with people who are so moved by such expressions that they are willing to invest significant sums to own them. On May 13, 2025, in New York,that encounter failed to happen. The missed rendezvous was a dramatic moment in the art world.

Uncertainty

In a climate of deep political and economic uncertainty—amid an America rattled by President Trump’s erratic decisions—Sotheby’s held its most anticipated modern and contemporary art sale of the spring (See here the report announcing the spring auctions). The highlight was the highest-estimated artwork of the year: a $70 million piece. It was a 1955 painted bronze by Alberto Giacometti. Grande tête mince (Large Thin Head) portrays the head of his brother Diego and has the particularity of being a profile in three dimensions. In other words, when viewed head-on, all you see is a sliver of metal.

Maeght

Though it is a rare piece due to its repainted surface, this work belongs to an edition of six. The last copy sold in 2020 for $53.2 million. This one also had excellent provenance—it came from the Maeght family of Saint-Paul de Vence, whose patriarch Aimé Maeght was Giacometti’s original dealer. The sculpture belonged to the late American real estate developer Sheldon Solow and was being sold to benefit charity.

Oliver Barker

Alberto GIacometti

Even so, in a cautious market, collectors were not convinced it was worth nearly $15 million more than the 2020 sale. Bidding stopped at $64.2 million. In a striking moment of silence, auctioneer Oliver Barker repeated the amount for several long minutes, hoping for a last-minute bid. None came.

Alberto Giacometti

Though 83.3% of the lots found buyers that evening, professionals widely agreed the Giacometti had been overestimated. Sotheby’s CEO Charles F. Stewart downplayed the miss: “This is a genuine auction moment. Today, auctions often feel like private sales, since so many works are presold through guarantees (1). In this case, no one was harmed—the seller only wanted to sell if a certain threshold was reached, and Sotheby’s wasn’t affected either. Everyone agrees it’s a masterpiece.”

No more aggressive prices

Still, the flop cast a shadow over the art market, which is actively searching for new bearings. One thing is clear: prices can no longer be inflated like they were five years ago. It was one of the most high-profile failures in recent memory, though not without precedent: In 2017, a Francis Bacon painting failed to sell at Christie’s in London with a $70 million estimate.

Safety nets

To avoid such public misfires, auction houses now rely on safety nets: financial guarantees from third parties or internal resources. On May 12, 2025, Christie’s auctioned the collection of the late Leonard Riggio, founder of Barnes & Noble, under full guarantee. The sale brought in $272 million. It most likely didn’t turn out to be a good deal for Christie’s.

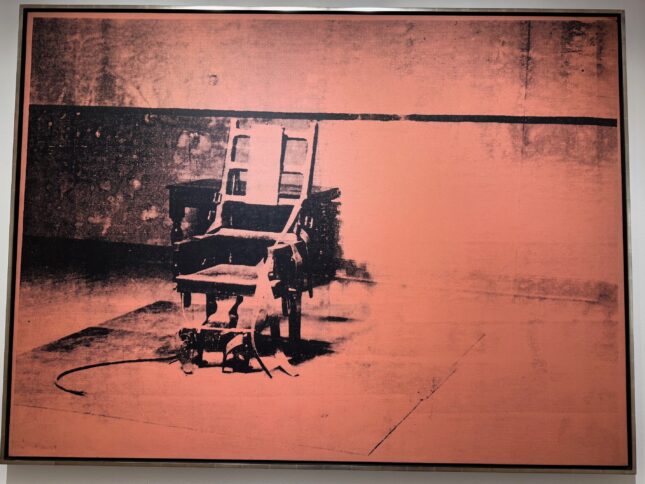

The vanishing Big Electric Chair

Andy Warhol

More controversially, Christie’s had included in its May 12 catalogue a Big Electric Chair by Andy Warhol, painted in orange-pink tones between 1967 and 1968—one of the darkest icons of American contemporary history, and among Warhol’s most famous works outside his portraits. But just before the sale began, it was quietly withdrawn without explanation.

An estimate of $30 million had been announced. Clearly, fearing a flop, Pinault-owned auction-house preferred to pull the piece rather than risk the blow to market confidence. Since it never made it to auction, it won’t appear in official stats.

Confidence?

More broadly, early May in New York is a critical time for all segments of the art market. As prices for 20th- and 21st-century artists have soared over the past decade, one must now ask: how much confidence remains in market players amid a clear dip in valuations at auction?

Frieze New York

Frieze New York took place at the futuristic Shed in midtown Manhattan, featuring 67 galleries focused on contemporary creation. On the fair’s final day, several dealers reported solid results. New York gallerist Miguel Abreu was surprised:“Even though Trump’s regime makes people cautious, the fair went well. There was strong interest and good sales. Everyone seems relieved.”

TEFAF New York

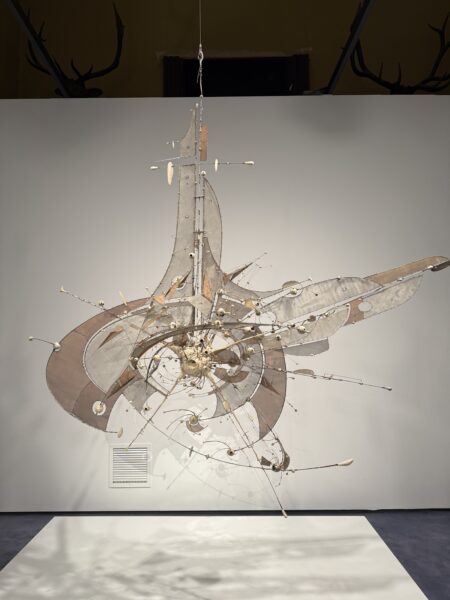

Lee Bontecou

That wasn’t quite the case at TEFAF New York, where offerings are more classical and prices higher. Among the 97 exhibitors, many expressed lukewarm satisfaction. Still, the fair contained one of the most beautiful things to see in New York at the moment at the joint booth of Marc Selwyn and Ortuzar Projects: a striking sculpture by American artist Lee Bontecou (1931–2022).

Created between 1980 and 2001, the work—part spider, part solar system—was made from silk, porcelain beads, and metal. Coming from the artist’s estate, it reportedly sold for $7 million. For context, Bontecou’s auction record is $9.1 million, set in 2021 for a 1960s piece.

Exceptional works still attract buyers—but not at any price.

Women artists

That point was driven home on May 12 at Christie’s, where a major geometric abstract painting by Piet Mondrian from 1922 sold for $47.5 million (estimate: $50 million).

Meanwhile, women artists continue their upward climb after centuries of under-recognition.

Dorothea Tanning

A surrealist painting by Dorothea Tanning (1910–2012) set a record at $2.3 million—more than double its estimate.

Georgia O’Keeffe

Georgia O’Keeffe

On May 13 at Sotheby’s, a vibrant 1942 red plant painting by Georgia O’Keeffe (1887–1986) fetched $12.9 million against an $8 million estimate.(See here a report about the O’Keeffe retrospective at Centre Pompidou).

Gerhard Richter

Gerhard Richter

One of the season’s big surprises was the sale at Christie’s of a romantic transparent mountain-and-sky landscape by Gerhard Richter from 1968, based on a photo taken in Corsica. It sold for $15.2 million—$3.2 million above estimate. (See here and here reports about exhibitions dedicated to Gerhard Richter).

Bonnie Brennan

“In turbulent times, people seek beauty and peace,” said Christie’s new C.E.O, Bonnie Brennan.

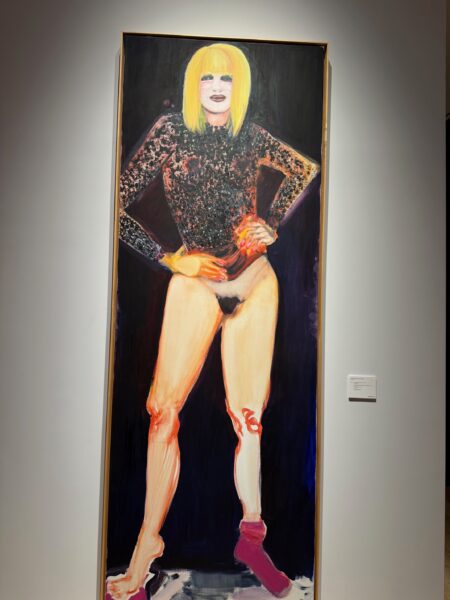

On May 14, Christie’s contemporary evening sale featured a major work by one of today’s most acclaimed painters: Marlene Dumas, belonging to the Miami-based collecting couple, the Rubells (See here an interview of Don Rubell in Miami). The 2.8-meter-tall painting of a spectacular figure, depicted lanky, dates from 1999. Estimated at $12 million, it was already being talked, before the sale, of as a new auction record for a living woman artist. Seeing as the work is guaranteed, expectations were sure to be met. (See here a report with an interview of Marlene Dumas).

Marlene Dumas

(1) The guarantee is an agreement prior to the sale that provides for a fixed sum of money to be paid to the seller regardless what happen in the room during the auction.

Support independent art journalist

If you value Judith Benhamou Reports, consider supporting our work. Your contribution keeps JB Reports independent and ad-free.

Choose a monthly or one-time donation — even a small amount makes a difference.

You can cancel a recurring donation at any time.