236.4 million

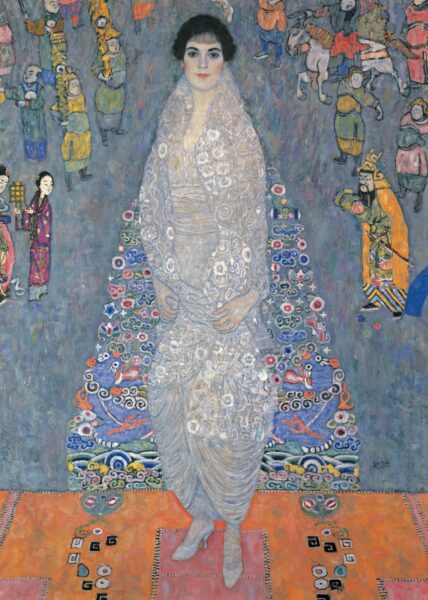

Gustav Klimt

Rationality is the enemy of artists. They obey more poetic rules, which lend an exceptional magic to the works they produce. As a result, these paintings or sculptures can sometimes exert a hypnotic power over art lovers. It is at that point that the art market itself also takes off in an irrational way. How else can one explain what compels a billionaire collector – unless it is a state – to bid again and again, millions upon millions, for a painting by Gustav Klimt… until, after 20 long minutes, the bidding reaches the colossal sum of $236.4 million.

Breuer Building

The scene unfolded on 18 November 2025 in Sotheby’s new premises in New York. We will almost certainly never know what was going through the mind of the person who acquired, for that amount, a large portrait of a young woman surrounded by a cascade of flowers and a chinoiserie-style décor. There were evidently six bidders who were deeply engaged in this battle. Painted by the Austrian Gustav Klimt between 1914 and 1916, this canvas of infinite grace now sits at the very top of auction results, just behind an Old Master painting executed by Leonardo da Vinci but subsequently far too heavily restored, the famous Salvator Mundi, sold for $450.3 million in 2017.

Brett Gorvy

“It was an extraordinary moment for the art market,” observes American dealer Brett Gorvy about the Klimt. “For many people who have made a great deal of money in recent years, confidence has returned with the arrival on the market of works of exceptional quality.”

The aura of Leonard Lauder

The canvas is considered a “trophy” in the international art ecosystem. It had until now belonged to a legendary collector, Leonard Lauder, who died in June 2025. To own one of his most famous pieces gives the illusion of possessing a little of his aura. The Lauder sale comprised 24 lots that fetched $527.5 million, against a low estimate of $400 million.

Curated sale

In the same vein, during the evening of 18 November, the sale dedicated to contemporary art in New York was also an outright success at Sotheby’s. The 43 works offered brought in $178.5 million, against an estimate of $143.6 million. The reason: the sale had been carefully “curated”, eliminating overly ambitious estimates and works that are less in vogue. “No one wanted a repeat of last season’s ‘Giacometti effect’,” notes Brett Gorvy, referring to an extraordinary, unique bronze Tête de Diego that went unsold at $70 million in May 2025.

Alberto GIacometti

Dark clouds and Middle East

Until October, dark clouds had been gathering over the trade in modern and contemporary art. Contemporary art seemed to be attracting only moderate interest, and China, a recent territory of conquest, was experiencing a massive downturn in transactions. Generally speaking, the art market is constantly striving to push back its geographical boundaries. It therefore came as excellent news this autumn that the Middle East is now firmly asserting itself as a new hunting ground for art acquisitions. On one side, Doha has announced that in February 2026 Art Basel Qatar will hold its first fair there, in association with a local freeport. Meanwhile, Abu Dhabi Art is to be transformed into Frieze Abu Dhabi from 2026 onwards. In the same spirit, the global circle of art lovers is eagerly awaiting the opening, by 2030, of the Art Mill Museum devoted to Western art in Doha. And the giant Guggenheim Abu Dhabi is expected to open, certainly during 2026. (Sotheby’s recently secured nearly one billion dollars from an Abu Dhabi sovereign wealth fund.)

Guggenheim Abu Dhabi

The American private newsletter Baer Faxt has even suggested that Abu Dhabi may be the buyer of the Klimt at $236.4 million.

Giovanna Bertazzoni

As with the Lauder collection, this season in New York a large number of high-quality works came onto the market through the estates of major collectors. “This influx of major pieces has made the market optimistic. We have been working intensively since the summer to put guarantees (1) in place, which likewise give clients confidence,” explains Giovanna Bertazzoni, Chairman, Europe, of the Impressionist and Modern department at Christie’s.

Ed Dolman

Ed Dolman, the former head of the auction house Phillips, now a private dealer, is categorical: “The crisis is over. The auction houses, and sellers too, have adjusted to a new situation with lower prices. Demand is mainly focused on blue chips.” He cites the example of a large abstract geometric painting in green tones from 1971 by the American Richard Diebenkorn (1922–1993), which belonged to the collector Elaine Wynn – ex-wife of the famous Las Vegas casino magnate Steve Wynn. It was sold for $17.6 million at Christie’s. When setting its estimate in 2025, Christie’s did not take into account the fact that in 2021 the same painting had been knocked down at $27.2 million. This is a time of wholesale revision of values.

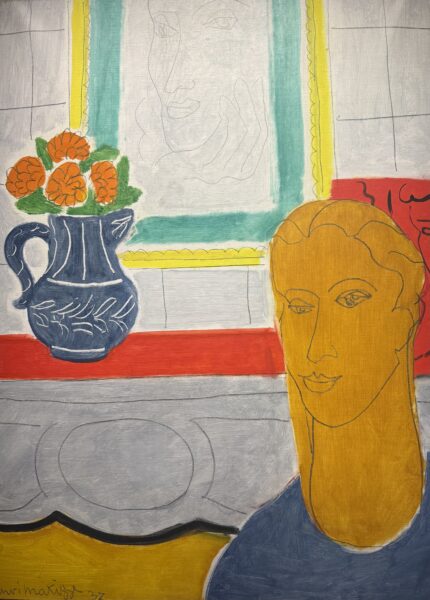

Matisse, the come back

Henri Matisse

Thus demand for Matisse had been relatively weak up to now – compared with canvases from the same period by his eternal rival Picasso – for works that combine painting and drawing on the canvas. This justified an estimate of $15 million for Figure et bouquet, from 1937, a very sketchy painting. It was sold by Christie’s for $32.2 million. “It was its resolutely modern character that carried the day,” comments Giovanna Bertazzoni.

Basquiat and Klein from France

Jean-Michel Basquiat

Among the season’s impressive results were several major works coming from France at Sotheby’s, such as a 1981 Basquiat canvas, Crowns. Peso neto, which belonged to the former French auctioneer Francis Lombrail. The painting, scattered with crowns – a true signature motif of the American artist– was sold for $48.3 million (estimate: $35 million). Similarly, there was a sculpture by Yves Klein (1928–1962), a large natural sponge impregnated with the artist’s famous blue, a symbol of the infinity of the underwater world, created around 1959, which had belonged to Denyse Durand-Ruel. This visionary, a friend of the artists of the French Nouveau Réalisme movement, who died in June 2025, had acquired it in 1965. It sold for $19 million.

Yves Klein

Christopher Wool

On 20 November, a painting by the American Christopher Wool (born 1955) emblazoned, in very large navy-blue letters on a white background, with the word RIOT, was sold for $19.8 million at Christie’s. In 2015, a comparable work – only the word RIOT was in black – had gone for $26.5 million, admittedly at the height of speculation on Wool.

Christopher Wool

Cautious always

If buyers are regaining confidence, they remain cautious. One of the season’s most media-hyped pieces, a solid-gold toilet titled America, by the mischievous Italian artist Maurizio Cattelan (born 1960) – the “father” of the scandalous banana taped to a wall – sold only for its metal value, at $12.1 million, in line with the estimate. According to the Artnet website, it belonged to star hedge-fund owner Steven A. Cohen.

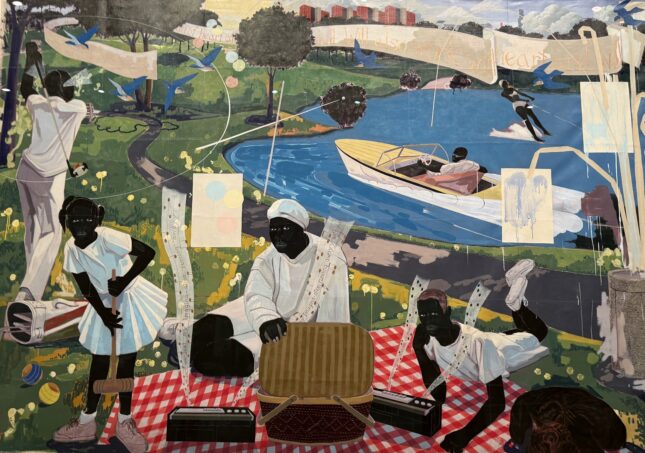

Kerry James Marshall

Kerry James Marshall

The greatest disappointment of the week in the field of contemporary art is undoubtedly the failure, with an estimate of $10 million, of a large canvas by one of the most important painters of our time, Kerry James Marshall (born 1955)at Sotheby’s. As a remarkable exhibition currently on view at the Royal Academy in London – which will come in September 2026 to the Musée d’Art Moderne in Paris – demonstrates, his sophisticated compositions, full of colour contrasts, depict the everyday life of the African-American community. On 20 November, however, Christie’s sold its Kerry James Marshall, an important 2007 portrait of a Black man against a black ground, Angry Black Man 1646, for $7.1 million. Here the artist illustrates how invisible people of African descent remained in the United States.

Kerry James Marshall

Puff Daddy

In 2018, one of the most extraordinary paintings by Kerry James Marshall, a large leisure scene by the water, had been sold for the record price of $21.1 million to a rapper known by the name Puff Daddy, now in prison. At the time, he too must have savoured the thrill of the final seconds of the record-setting sale in his favour.

Times change… The painting is now on view in London, bearing the label “Private collection”.

Kerry James Marshall

(1) Guarantee: a sum paid to the seller by the auction house or by a third party in the event that the level of bidding is insufficient. In that case, the guarantee serves as the hammer price.

Support independent art journalist

If you value Judith Benhamou Reports, consider supporting our work. Your contribution keeps JB Reports independent and ad-free.

Choose a monthly or one-time donation — even a small amount makes a difference.

You can cancel a recurring donation at any time.