Bonnie Brennan has been Christie’s Worldwide Chief Executive Officer since February 2025. Closely tracking new market dynamics, she says she is “very optimistic about 26” . I interviewed her at the end of December. Christie’s communications team declined to publish the video interview conducted via Teams. As a precaution, and in light of the recent news, I asked whether anything needed to be added at the beginning of January. The answer was: no.

However, last May I did a brief video interview with Bonnie Brennan published here.

The interview has been slightly edited and modified for ease of reading.

My first question concerns the period of political, economic, and geopolitical uncertainty we are going through. In this situation, how do you address collectors?

I think we had such a solid first half of 2025. It was very, very strong. It was flat out the year before, but what we saw in the back half was tremendous momentum and real enthusiasm—and that was not limited to a certain geography or a certain category.

This fall, I was in every sale room: Hong Kong, Paris, London, New York. And just incredible packed sale rooms, depth of bidding, great competition— it generated some really strong prices. In December in London we sold a Fabergé egg that set a new record for Fabergé: $30 million. ([Ed.] Record for a Fabergé object.)

How do you explain these strong results in such a context?

In New York, for example, people continued to have satisfactory business activity, and it gave them, in a way, the permission to focus a little bit more on our world. The second thing is that, because of the stability that we generated in the first half, it gave collectors and consignors confidence to sell their material. So the supply was strong.

During the contemporary art sales in New York in November, Gael Neeson, the widow of Stefan Edlis ([Ed.] the famed Chicago collector, now deceased), decided to put certain works up for sale.

She didn’t need to sell. She chose. She could have waited if she didn’t feel confident in the market… ([Ed.] The sale, estimated at $30 million, realised $49.2 million, with an Andy Warhol Last Supper painting as the highlight, sold for $8.1 million.)

What did you say to persuade her to entrust her works to you?

I think it was two things. First, she built a wonderful legacy with her husband. And being able to tell that story—who they were as collectors, and then tell the full story—mattered. The pre-sale exhibition celebrated not only the works, but also the design of how they lived. They really were collectors in the truest sense of the word. We showed the world their whole environment. And I think that excited her.

More generally, which areas are currently being driven by this desire to buy?

They want to spend it on a lot of different things. We had a tremendously strong jewellery sale in May for JAR—great collection, it really blew through the estimates. ([Ed.] 21 lots estimated at $3 million, sold for $7.1 million.)

In 2024 we acquired a collector-car auction house, Gooding. During the Pebble Beach sales in summer 2025, somebody paid $25 million for a Ferrari. ([Ed.] Specifically $25.3 million for a 1961 Ferrari GT California Spider Competizione.)

However, China—formerly a major force in the art market—has been noticeably less active for several years, among other reasons because of the real-estate crisis and the difficulty for collectors to move money out of the country.

There are challenges with currency, but we actually saw participation. In the Asia-Pacific region at Christie’s, Mainland China is the second-largest buyer after Hong Kong. We also note that India, for example, saw its activity increase by 25% in 2025.

In 2026, Art Basel is setting up in Doha and Frieze in Abu Dhabi. What is your strategy in the Middle East?

We’ve been in Dubai for 20 years. It’s not a region that’s new to us. We have robust relationships in the UAE. I have three trips planned for the Middle East before June. We see a real opportunity to meet that curiosity with content, with programming, making sure we build relationships with new collectors in the region. Their interests are very varied: luxury, watches, jewellery… We also exhibited works from our 20th- and 21st-century sales in Dubai in 2025.

Sustain Our Work with a Small Monthly Gift

It’s very simple. Just $10 a month allows us to keep going.

Reliable information is valuable.

This year, influential galleries have closed around the world. How do you explain this gap between the results reported by galleries and those of auction houses?

We have the benefit of being in 80 categories. There’s a rich diversity in what we offer, and I think that gives us great stability and health: when one market is stronger, it accommodates those that might be a little bit softer.

We are constantly being good listeners to what the market and new collectors want. That’s why we’re always thinking about adding categories—why we bought the car auction house, why we started the 21st-century sale. We also sold a dinosaur. ([Ed.] An oviraptorosaur estimated at £3 million and sold for £3.4 million in London in December 2025.)

What are the most striking new trends in the market today?

A few things come to mind.

First, modern masters—not only at the masterpiece level, but also in the day sales. The day sales are really the core strength; sometimes they’re the best health indicator of the market. Demand is very strong there, and it’s also very strong for modern design.

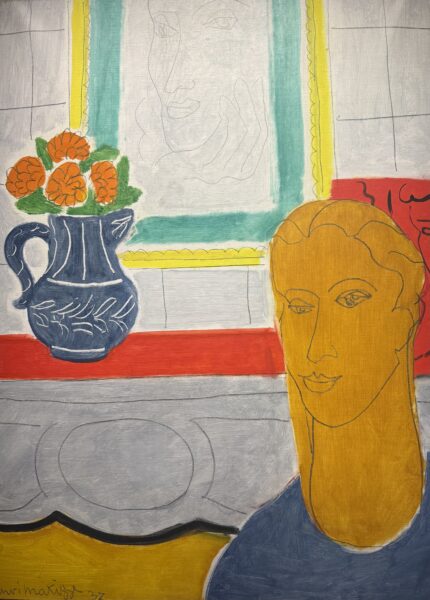

Henri Matisse

In modern art, look at Matisse: some of the deepest bidding wars we had in our New York sale room were for Matisse. That hasn’t always been the case.

Second, younger buyers show a bigger focus on second-hand, driven by interest and commitment to sustainability. That shift will have a very positive impact on how we engage with that audience. Buying a second-hand watch rather than going to Rolex or Tourneau… The principle applies in other fields. In March we will sell Kurt Cobain’s guitar. It’s exciting for the prospect of widening our client base. And many younger Asian collectors are also coming to us through luxury purchases.

Another phenomenon is the growing importance of private sales. In 2025 they represented $1.5 billion—just over 25% of our total business across all categories. Some collectors want a little bit more privacy. Private sales are a very custom, completely personalised offer.

What is happening in the market for very contemporary artists—for African American artists, for example?

We’re watching. It’s a long-term play, and our job is to manage those sales, manage the inventory, and present what really reflects where we see strength.

Christopher Wool

We have observed, for example, ups and downs in Christopher Wool’s market ([Ed.] an American artist born in 1955, working, among other things, on the idea of the image and its reproducibility), and I was really pleased with the November result—a really strong signal to the market. ([Ed.] A work painted in 1990, marked in blue with the letters RIOT, sold for $19.8 million on 19 November 2025.)

What is your policy today regarding estimate levels?

We’re very nimble. Our teams are always reflecting where the market is. We’re in a sales business, and the whole magic of auction is filling our room and getting people to raise their paddles. The estimate is one piece of that. Ultimately, it’s the collectors who decide the pricing—sometimes well beyond expectations. But yes, we need to guess, grounded in what has sold before: what’s sold recently, and why this one is different. With objects, it’s hard—which is why human engagement will always be part of the process.

In which areas do you use artificial intelligence today?

We will happily use AI to enhance, but it does not replace that process. We do not use it for setting estimates. We use AI in the business to help study trends, and in marketing—for example, to help us navigate where we’re seeing interest and engagement. It also helps optimise certain processes, like cataloguing. Last year, 81% of our activity relied on online digital tools.

What can we expect in 2026?

I’m very optimistic about 26. Starting a year with this excitement is a great kickoff, and it makes it much easier for the teams at Christie’s to convince sellers.

We will sell the Jim Irsay collection ([Ed.] considered the most important guitar collection in the world). We are also marking major anniversaries in 2026, including the 250th anniversary of the United States, with, among other things, the largest collection of the American West, sold in January.

The Culbertson Guidon from the battlefield on the Little Bighorn River.

Support independent art journalist

If you value Judith Benhamou Reports, consider supporting our work. Your contribution keeps JB Reports independent and ad-free.

Choose a monthly or one-time donation — even a small amount makes a difference.

You can cancel a recurring donation at any time.